Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

We’ve got new and reduced rates

We’ve updated our product range

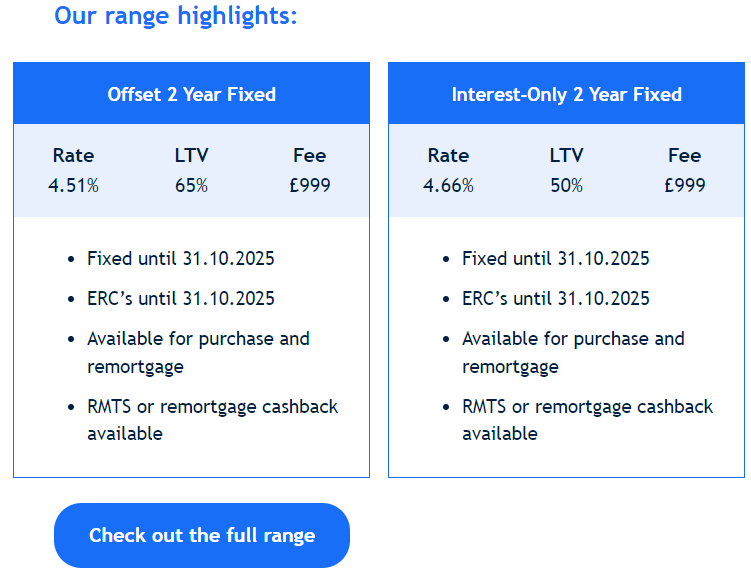

It’s good news for your clients, as we’ve reduced our entire Offset, Interest-Only and Offset Interest-Only ranges.

That’s not all – we’ve also introduced new rates to these ranges giving more options for your clients.

What you need to know

- We’ve introduced 2 and 5 year Offset rates across 65%-75% LTV

- We’ve introduced 2 year Interest-Only and Offset Interest-Only rates at 50% LTV

- We’ve reduced 5 year Offset rates at 75% LTV

- We’ve reduced 5 year Interest-Only and Offset Interest-Only rates

Want to learn more about how we can support you and your offset clients?

Supporting clients with retrofitting

Rewarding retrofitting

Government proposals to raise minimum EPC rating requirements for rental properties have sparked interest amongst consumers in making green home improvements.

But with the mortgage market now offering a range of solutions for Buy to Let and Residential customers, from green mortgages to cashback schemes, making the right choice can be confusing.

In fact, research by Coventry Building Society suggests that 74% of homeowners are even unsure about their property’s EPC rating1

Brokers are well placed to step up and guide customers on these issues, but it’s important to keep up to date on the latest legislative proposals, as well as what’s on offer from lenders. Resources such as the Green Finance Institute’s ‘Broker Handbook’ can help brokers understand the different green retrofitting solutions on offer and how the latest regulatory changes can affect your clients.

How can we help?

At Coventry for intermediaries, we’re committed to helping your clients reduce their property’s carbon footprint, just like we’ve reduced our own impact on the environment by cutting the energy and resources we use in our offices.

Through our Green Together Reward:

- We offer £500 to eligible Buy to Let and Residential clients who make qualifying energy efficient home improvements

- Your client must spend a minimum of £2,500

- Open to both residential and BTL clients who applied for a new mortgage or change their existing mortgage or terms on or after 28 September 2021.

- We validate the claim with TrustMark and pay £500 directly into the account your client set up with us to make your mortgage payments.

- They can choose from more than 20 types of efficiency improvements

Find out more about how to help your clients navigate green mortgages in our blog.

Product updates

We’re updating our rates

In line with our commitment to give you two days’ notice of product closures, we will be closing products at 8pm Thursday 27 April.

We will be launching new products at 8am Friday 28 April.

Here’s what’s changing:

Owner-Occupied (new business)

- Increasing 2 & 3 year Fixed New Business rates at 65-85% LTV (Excl. Interest-only, Offset & Offset Interest-only)

Buy to Let(new business, porting, further advances and product transfers)

- No changes to the range

New business cases

Remember, an AIP does not secure a closing product. If an AIP refers, we can’t guarantee we’ll be able to review it before the product is closed.

So, if your AIP does refer, you should copy the case and click through to full mortgage application to secure the product. Applications received after 8pm Thursday 27 April will not be accepted.