Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

We’re updating our rates

In line with our commitment to give you two days’ notice of product closures, we will be closing products at 8pm Thursday 13 April.

We will be launching new products at 8am Friday 14 April.

Here’s what’s changing:

Owner-Occupied (new business, porting, further advances and product transfers)

- Reducing all 2, 3 & 5 Year First Time Buyer only fixed rates across 90-95% LTV

- Reducing all 3 Year £999 fee Existing Client only fixed rates across 85-95% LTV (excluding Offset and Interest-only)

- Reducing all 5 Year no fee Existing Client only fixed rates across 90-95% LTV (excluding Offset and Interest-only)

- No changes to Offset, Interest-only or Tracker rates

Buy to Let (new business, porting, further advances and product transfers)

- Reducing all BTL & Portfolio Landlord BTL fixed rates across 50-65% LTV

- No changes to Tracker rates

New business cases

Remember, an AIP does not secure a closing product. If an AIP refers, we can’t guarantee we’ll be able to review it before the product is closed.

So, if your AIP does refer, you should copy the case and click through to full mortgage application to secure the product. Applications received after 8pm Thursday 13 April will not be accepted.

Product transfers

For product transfers the following will apply:

Online product transfer cases will need to be fully submitted by 8pm Thursday 13 April.

Product transfer paper application packs already provided need to be fully completed, signed by all applicants, and returned by 8pm Thursday 13 April.

Pending product transfer paper application packs and requests received between today’s date and 8pm Thursday 13 April need to be fully completed, signed by all applicants, and returned within 48 hours of the date of illustration.

We’ve dropped selected rates

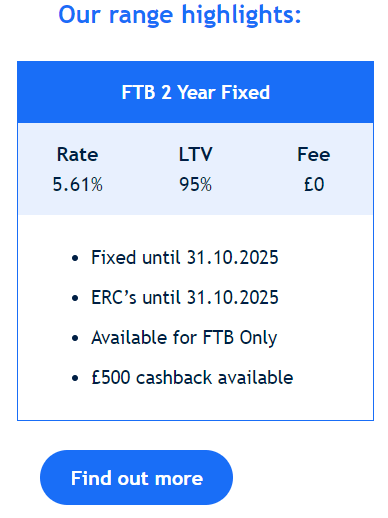

It’s good news for your FTB clients, as we’ve reduced our entire FTB Only range. Our income multiple is up to 4.49x on >90% LTV, making it a great time to check your client’s affordability.

That’s not all – we’ve also reduced selected Residential and Buy to Let rates.

What you need to know

- We’ve reduced all standard 2, 3 and 5 year FTB only fixed rates at 90-95% LTV.

- We’ve reduced all standard 2, 3 and 5 year FTB only fixed rates at 90-95% LTV.

- We’ve reduced all 5 year no fee PT and FA fixed rates at 90-95% LTV.

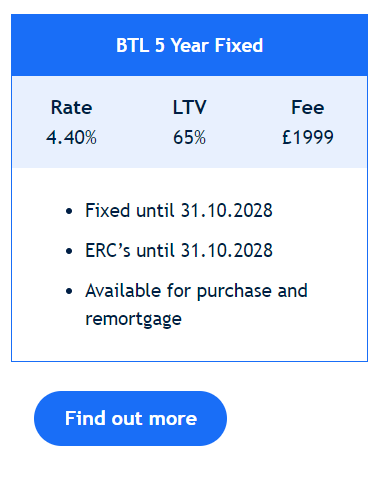

- We’ve reduced all BTL and PL BTL fixed rates at 50-65% LTV.