Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

Product updates

We’re reducing our rates

True to our pledge to give you two days’ notice of product closures, our latest changes will come into effect from 8am Wednesday 26 January.

Here’s what’s changing:

Owner-Occupied

- No changes to the range

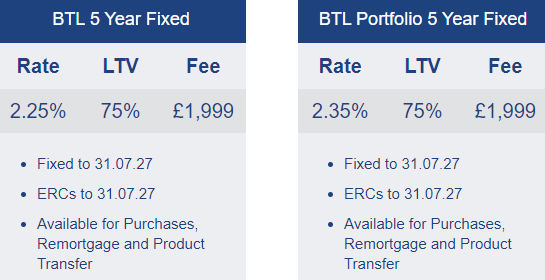

Buy to Let

- 2 & 5 Year Fixed BTL at 75% LTV rates reducing by up to 44 basis points

- 2 & 5 Year Fixed Portfolio Landlord BTL at 70%-75% LTV rates reducing by up to 60 basis points

Remember, an AIP does not secure a closing product. If an AIP refers, we can’t guarantee we’ll be able to review it before the product is closed.

So, if your AIP does refer, you should copy the case and click through to full mortgage application to secure the product. Applications received after 8pm Tuesday 25 January will not be accepted.

Visit our website for more information on our Lending policy.

All products will be available to view on our website from day of launch.

Further BTL Rate Reductions!

Selected BTL and Portfolio Rates Reduced

At the start of the month we reduced our BTL and Portfolio range and we’re glad to say that the good news continues! We are making further cuts to the BTL 75% LTV range by up to 44bps.

But, it doesn’t stop there – BTL Portfolio 70-75% LTV rates are also being reduced by up to 60bps!