Foundation Home Loans has updated its range across the direct to lender and packaged range. Brilliant Solutions offers fees free packaging across the range as well as direct to lender access with payment on completion.

BTL Re-price

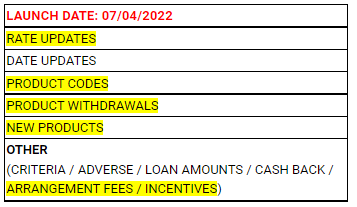

Foundation Home Loans will re-fresh its current BTL & Limited Company products on the morning of 7 April 2022 as follows:

- The relaunch of 38 products

- The launch of two new products representing a large HMO/MUB variant for Expats

- The withdrawal of 66 products

Product withdrawal of our openwork exclusive product and other rates

On Wednesday 6th April at 5:30pm, we will be making a number of changes to our buy to let range.

As part of these changes many of our products are being replaced, including our Green ABC+ products which are being withdrawn and replaced with a revised green product range.

Products being withdrawn and not replaced are:

- All 5 year fixed, fee assisted products

- All limited edition fee assisted products for specialist property types

- Our F1 & HMO early remortgage products

Please key your DIP as soon as possible.

Any DIPs on existing products will need to be received by 5:30pm on Wednesday 6th April. You will then have 30 days from your DIP accept date (please refer to your illustration for this date) to progress to FMA.

Please note that our broker portal will be down from 5:30pm on Wednesday 6th April in order to release our new products, it will be available again from Thursday morning.

FOUNDATION RELEASE NEW GREEN ABC+ PRODUCTS

AND INTRODUCE EXPAT LARGE HMO PRODUCT

As of 7th April 2022, Foundation Home Loans are offering a new BTL Green ABC+ range exclusively for properties with EPC rating of A-C. The new Green products include one free valuation and come with a 1% product fee.

- Single products covering properties with EPCs A to C

- F1 5-year fixed rate at 3.49%

- Up to 75% LTV

- NEW: One free valuation

- Options for HMOs, short-term lets and UK expatriates

- 1% product fee

- For purchase and remortgage

Foundation Home Loans have introduced a new Expat product for landlords purchasing or remortgaging a large HMO (up to 8 bedrooms) or multi-unit blocks (up to 10 units).

- 5-year fixed rate at 3.99%

- Up to 75% LTV

- 25% product fee

For more information, please contact us.

Why use Foundation for your next BTL case?

Who for?

- Experts in individual or limited company applications

- Up to 4 directors & no personal guarantees needed for shareholders

- Limited companies/SPV with complex structures

- Shareholding can include other companies

- Newly formed SPV’s and flexible deposit sources including Intercompany loans

- No min income or employment/self-employment history

- First time landlords considered

- Ex-pats considered as individuals or limited companies

How much?

- Up to 85% LTV & Loans up to 2m (on core range)

- ICR of 125% for limited company borrowers and basic rate taxpayers

- No limit to portfolio size, subject to maximum borrowing of £5m with Foundation

- Portfolio in the background stress tested at 100%

What for?

- HMOs: standard to 6 bedrooms, large up to 8 bedrooms and MUBs: up to 10 units

- Short term lets in personal or SPV structures

- Day 1 remortgages

- Products without ERCs

- Range of Green Products for properties with EPC rating A-C