See the latest announcement from HSBC below. Note that you can access HSBC via the Brilliant Solutions mortgage club but the lender does place some restrictions on access. Contact us for details.

HSBC Mortgage Product Guides are available here but check the date to ensure it has been updated to reflect the announcements below.

Good news – we’ve enhanced our residential lending policy

With effect from Monday 1st September, we will be making the following changes to our residential lending policy.

Introducing Loan to Income (LTI) multiples for First Time Buyers (FTB)

To support FTBs we have introduced new LTI multiples to help them take their first steps into home ownership.

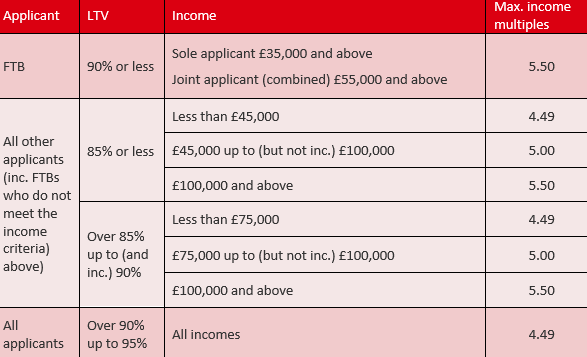

A higher income multiple is now available subject to meeting the following criteria:

- Applicant(s) must be a FTB

- Sole applicant – a minimum income of £35,000

- Joint applicants – a combined minimum income of £55,000

Changes to non-FTB LTIs

We’ve increased the maximum LTI for non-FTB customers with an income of £45,000 up to (but not inc.) £100,000 from 4.75 to 5.00 x income, where LTV is less than or equal to 85%.

Please see the below table for further details on our LTI changes:

Changes to our Interest Only lending policy

We’ve changed how we assess Interest Only applications to help more customers with their mortgage needs:

- Increased the maximum term for Part & Part applications – the Capital Repayment element can now be taken up to a maximum of 40 years. Please note, the Interest Only part will still be limited to a maximum of 25 years.

- Increased the maximum age for Part & Part applications – the Capital Repayment element can now be taken up to the applicant’s 80th birthday.

- Any element of the application on Interest Only must not exceed the oldest applicants 70th birthday or anticipated retirement age if sooner.

- All Interest Only applications will now be assessed for affordability on a Capital Repayment basis

Current Service Levels

Please note, our Service Levels are now updated daily on the broker website. Before contacting our Broker Support Team for a case update, please check the case tracking facility and the messages section on our broker portal.