Metro Bank have announced a broker update, available below. Contact us to see how we help brokers like you across the UK, Alternatively please refer to our Mortgage Lending Criteria Guide and Product Guides.

Announcement

NEW NEAR PRIME RESIDENTIAL MORTGAGES

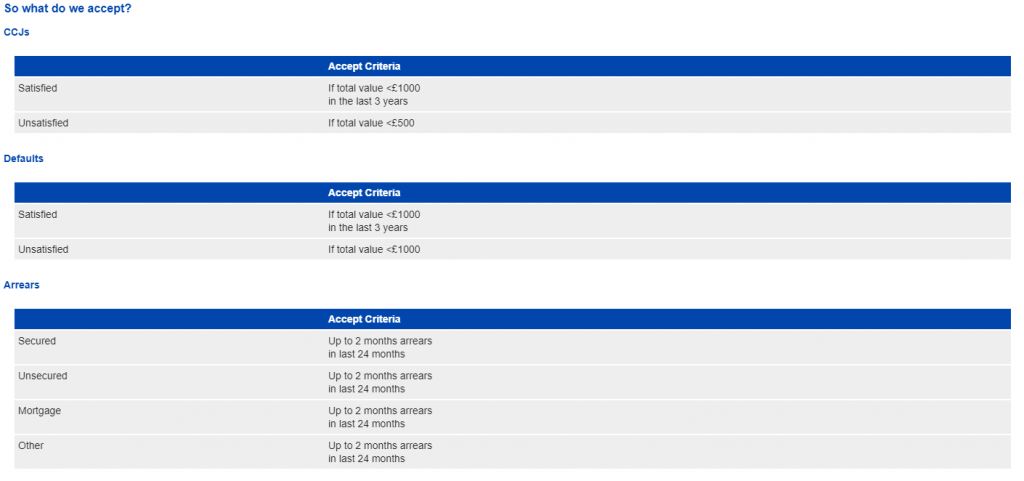

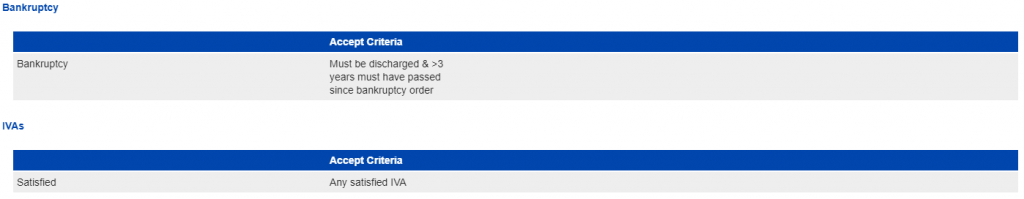

Metro Bank has expanded its product range further and launched a near prime residential range for customers with a less than perfect credit profile or a low credit score, offering greater flexibility for those that may be struggling to get a mortgage elsewhere.

Near Prime highlights

- Lower credit score requirement

- Loans available from £50,000 – £500,000 for purchase and re‑mortgage

- Maximum LTV of 80%

- 2 & 5 fixed rates starting from 3.79%

- Capital and interest repayment only

- Capital raising, including debt consolidation accepted – new Debt Consolidation Form required for debt consolidation applications

- Joint borrower, sole proprietor – only where the additional borrower(s) is a close family relative

- Maximum age 80 (mortgage term based on the oldest applicant)

- Up to 4 applicants on the mortgage can be considered

All cases are subject to full assessment and a credit score pass. For full details on the points above and our full near prime lending criteria, please visit our Feature of the Week or refer to our Lending Criteria Guide and Product Guides