See the latest announcement from TSB below. Note that you can access TSB via the Brilliant Solutions mortgage club but the lender does place some restrictions on access. Contact us for details.

TSB Mortgage Product Guides are available here but check the date to ensure it has been updated to reflect the announcements below.

Important News from TSB: Residential rate changes.

TSB has made changes to Residential rates effective from Wednesday 17 November.

Rates reduced on:

- 2 & 5 Year (5 Year ERC) Fixed First Time Buyer and House Purchase 85-90% LTV by 0.20%.

Rates increased on

- 5 Year Fixed (3 Year ERC) First Time Buyer, House Purchase and Remortgage 0-75% LTV by

up to 0.45%.

Important News from TSB:

We’re increasing maximum LTV on new build properties.

TSB has increased maximum LTV for new build Residential and Buy to Let products from 16 November.

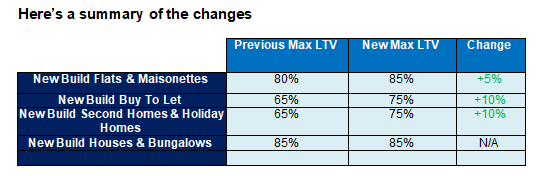

Maximum LTV for new build flats and maisonettes is now aligned to maximum LTV for new build houses and bungalows at 85% LTV. Maximum LTV on new build second homes, new build holiday homes and new build Buy to Let properties has also increased from 65% to 75%.

Maximum LTV is subject to credit score and the actual LTV offered may vary.

Here’s a summary of the changes.

To find out more about TSB’s lending criteria visit the website.

TSB is helping First Time Buyers and Homemovers by offering lower rates on new

build properties for Help to Buy, Shared Equity and Shared Ownership mortgages.

See the latest product guide for more information.